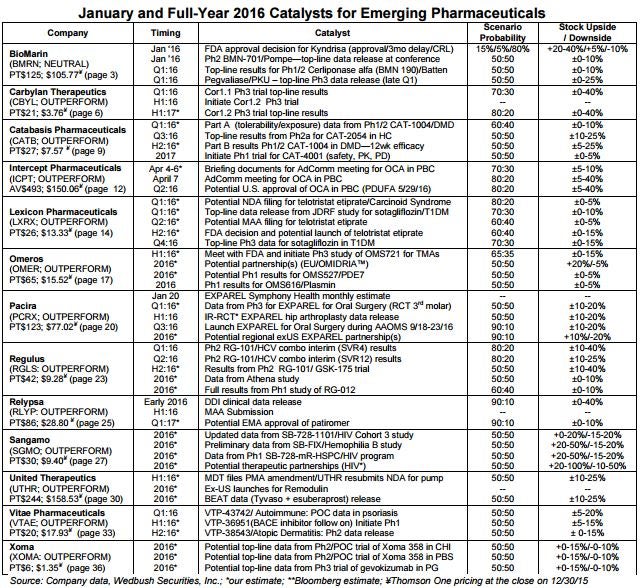

In a new report, Wedbush analyst Liana Moussatos breaks down potential 2016 catalysts for every emerging pharmaceuticals stock under the firm’s coverage. Overall, Wedbush is very bullish about these 11 Outperform-rated stocks headed into 2016.

Wedbush expects approval of Hydros-TA by early 2018 and a launch by mid-2018. The firm projects peak sales of Hydros-TA for treatment of osteoarthritis pain of the knee of $770 million by 2023 and has a $21 price target on the stock.

Catabasis Pharmaceuticals Inc (NASDAQ: CATB)

Wedbush is confident in the company’s management and predicts “blockbuster sales potentials for Catabasis’ clinical candidates due to oral delivery, competitive clinical proficles and premium pricing for orphan drugs.” The firm has a $27 price target for the stock.

Related Link: 5 'Bold' Predictions For 2016

Intercept Pharmaceuticals Inc (NASDAQ: ICPT)

Wedbush believes Intercept’s intellectual property in bile acid chemistry gives the stock an attractive risk/reward profile based on the likelihood of clinical success and relatively low regulatory and commercial risk. The firm has a $493 price target for the stock.

Lexicon Pharmaceuticals, Inc. (NASDAQ: LXRX)

Moussatos explained, “With at least two potentially significant drug candidates in late-stage clinical development and the ability to refill their pipeline from a drug discovery platform which integrates in-house medicinal chemistry and proprietary gene knockout platforms, we see significant potential upside for the stock.” Wedbush has a $26 target for Lexicon.

Omeros Corporation (NASDAQ: OMER)

Wedbush likes the company’s robust pipeline that ranges from preclinical-stage candidates to FDA-approved OMIDRIA. The firm has a $65 price target for the stock.

Pacira Pharmaceuticals Inc (NASDAQ: PCRX)

Wedbush likes the long-term growth prospects of EXPAREL and noted that Pacira could be both an acquirer of hospital products and also a potential buyout target of larger companies. The firm has a $123 price target on the stock.

Regulus Therapeutics Inc (NASDAQ: RGLS)

Wedbush believes that Regulus’ microRNA platform will likely continue to draw partnership and buy-out interest from big pharmaceutical companies. The firm has a $42 price target on the stock.

Relypsa Inc (NASDAQ: RLYP)

The FDA approved Veltassa on October 21, 2015, and the drug was launched in December. Wedbush projects peak annual Veltassa sales of over $1 billion and has a $86 price target on Relypsa’s stock.

Sangamo Biosciences, Inc. (NASDAQ: SGMO)

Wedbush likes what it sees in Sangamo’s proprietary zinc finger technology and believes that the company has plenty of cash (and potential for partnerships) to pursue cures for diseases such as hemophilia, Huntington’s and sickle cell. The firm has a $30 price target on the stock.

United Therapeutics Corporation (NASDAQ: UTHR)

Wedbush calls United’s leadership “one of the best management teams in the industry” and believes that the company’s focus on free cash flow and patent-friendly product candidates will spearhead the company’s continued growth in years to come. The firm has a $244 price target on the stock.

Vitae Pharmaceuticals Inc (NASDAQ: VTAE)

Wedbush sees no cost-related roadblocks in the clinical development of VTP-36951 and noted the huge potential market for Alzheimer’s treatments. The firm has a $20 price target on the stock.

XOMA Corp (NASDAQ: XOMA)

Wedbush projects peak annual sales for Gevokizumab of $450 million by 2022 and peak XMet program sales of more than $3 billion for diabetes and hyperinsulinemic hypoglycemia. The firm has a $6 target for the stock.

Catalysts

A full outline of all the potential 2016 catalysts for the stocks mentioned above, as well as Wedbush’s probabilities for favorable outcomes, are included in the following table.

Disclosure: The author holds no position in the stocks mentioned

http://finance.yahoo.com/news/every-biotech-catalyst-wedbush-watching-012022405.html

No comments:

Post a Comment